Introduction

This reference document provides details of the QuantReplay Market Simulator Representational State Transfer (REST) API.

Scope

This document provides technical-level details of using the administrative functions through the REST API of the QuantReplay Market Simulator, for modifying administrative settings and sending administrative requests to market simulator instances.

General

REST Logic

Market Simulator instances interact. So, if a person sends a request about Venue status from one Market Simulator, the system can receive it in another Market Simulator, process it and return a response. Final response to this person will be provided from the initial Market Simulator from which the person sent a request.

It is possible to check the status of the Market Simulator instance. All Market Simulators have REST patterns - types of requests that they can accept and process. If Market Simulator receives REST request that it cannot process, it returns an error - e.g.: method is unavailable.

The commands to Check Status, Stop/Start order Generation, check its status, etc. do not influence the Database, they influence only the work of the current simulator instance.

REST Requests

You can go straight to the Database and make the necessary changes for the Market Simulator instance, but it requires access to the Database. As an option, it is possible to send REST request from outside.

A client (e.g.: a Web interface) can make a request to the REST engine of one of the simulator instances - REST call to the REST port of one of the simulators - with the request to make some changes on the LSE instance, for example. It is possible to send status request, change the status,stop/start orders generation, etc. Market Simulator makes the requested changes in the Database. There is NO UM Messaging, Market Simulator instances communicate over REST.

REST Usage

All that we have in the Database should be accessible through REST. It is possible to compare the Database and GET REST request.

Through REST it is possible to:

-

see some specific listing / venue / data sources

-

see all listings / venues / price seed

-

see venue / multiple venues status

-

see order generation status

-

start / stop order generation

-

update some listing / venue / price seed / data sources /settings

-

add listing / venue / price seed / data sources / settings

-

send order

Market Simulator gets data from the Database at its start, as a result, Market Simulator provides only current data to REST.

| Changes made directly to the database may require a restart of the simulator process in order to make these changes visible through the REST API. |

Base URL

Requests to the Market Simulator REST API are unsecured, since the Market Simulator deals only with non-production simulated market data and trades in testing environments.

Request Methods

HTTP GET

Market Simulators use the GET request to retrieve information about the specified system resource, and can return the following response codes:

| Status Code | Meaning |

|---|---|

200 OK |

Request was successful and the response body contains the requested resource. |

404 NOT FOUND |

The requested URI or resource identifier is unknown. |

412 PRECONDITION FAILED |

The value of the |

500 SERVER ERROR |

Request could not be processed due to an internal server error. |

503 SERVICE UNAVAILABLE |

System is temporarily unable to process the request. Please wait and then try again. |

HTTP POST

Market Simulators use the POST request to add one or more new resources to the system or make complex requests, and can return the following response codes:

| Status Code | Meaning |

|---|---|

201 CREATED |

Request was successful, we added the new resource(s) and the response body contains the validated form of the resource(s) or the response to a complex request. |

400 BAD REQUEST |

The request failed validation, see response body for details. |

403 FORBIDDEN |

User is not allowed to execute requested action, see response body for details. |

404 NOT FOUND |

The requested URI is unknown. |

405 METHOD NOT ALLOWED |

POST is not valid for the specified resource. |

409 CONFLICT |

Request could not be processed due to an inconsistent server state, see response body for details. |

412 PRECONDITION FAILED |

The value of the |

500 SERVER ERROR |

Request could not be processed due to an internal server error. |

502 BAD GATEWAY |

Request could not be forwarded to destination simulator instance, see response body for details. |

503 SERVICE UNAVAILABLE |

System is temporarily unable to process the request. Please wait and then try again. |

HTTP PUT

Market Simulators use the PUT request to update one or more existing resources in the system, and can return the following response codes:

| Status Code | Meaning |

|---|---|

200 OK |

Request was successful, we updated the resource(s) and the response body contains the validated form of the resource(s). |

204 NO CONTENT |

Request was successful, we updated the resource(s) and the response body is empty. |

400 BAD REQUEST |

The request failed validation, see response body for details. |

404 NOT FOUND |

The requested URI or resource identifier is unknown. |

405 METHOD NOT ALLOWED |

PUT is not valid for the specified resource. |

412 PRECONDITION FAILED |

The value of the |

500 SERVER ERROR |

Request could not be processed due to an internal server error. |

503 SERVICE UNAVAILABLE |

System is temporarily unable to process the request. Please wait and then try again. |

HTTP DELETE

Market Simulators use the DELETE request to remove one or more existing resources from the system, and can return the following response codes:

| Status Code | Meaning |

|---|---|

204 NO CONTENT |

Request was successful, we deleted the resource(s) and the response body is empty. |

404 NOT FOUND |

The requested URI or resource identifier is unknown. |

405 METHOD NOT ALLOWED |

DELETE is not valid for the specified resource. |

412 PRECONDITION FAILED |

The value of the |

500 SERVER ERROR |

Request could not be processed due to an internal server error. |

503 SERVICE UNAVAILABLE |

System is temporarily unable to process the request. Please wait and then try again. |

Data Format

Request Headers

| HTTP Header | Value type | Required | Meaning |

|---|---|---|---|

X-API-Version |

string |

No |

Defines the REST API version. If it mismatches with the simulator major version, the response is sent with status code 412 PRECONDITION FAILED. The equality of versions is only checked if the request contains the header. |

Request Body

In the case of requests that contain a body (generally POST and PUT requests) the body must be sent in JSON format, using the following request header:

Content-Type: application/json

All property names in the request body must be double quoted. See below for further details on the format of specific types of request body values.

Response Body

In the case of responses that contain a body (generally GET, POST, and PUT responses) the body will be sent in JSON format. All property names in the response body will be double quoted. See below for further details on the format of specific types of response body values.

Strings

Any string values sent as part of a JSON request or response must be wrapped in double quotes. In the case where an indication of "no value" is required, a null property value may be specified.

Example

{

"myStringProperty":"myStringValue",

"myEmptyStringProperty":null

}Numbers

Any numerical fields (Integer or Float) sent as part of a JSON request or response must not be wrapped in double quotes. In the case of Float values, a period ( "." ) must be used as the decimal separator, regardless of a user’s regional settings. In the case where an indication of "no value" is required, a null property value may be specified.

Example

{

"myIntegerProperty":123,

"myFloatProperty":123.456,

"myEmptyNumberProperty":null

}Date/Time

All time stamps sent to or returned from Market Simulators must be expressed in UTC.

Time stamps with second granularity are expressed using the format: yyyy-MM-ddTHH:mm:ss

Example

2015-09-08T15:32:09

Time stamps with milli-second granularity are expressed using the format: yyyy-MM-ddTHH:mm:ss.SSS

Example

2015-09-08T15:32:09.119

Random Order Generation

Some notes on understanding how random order generation works in the market simulator.

Distribution of Actions

The simulator uses a separate pseudo random number generator per listing so that as each random action is determined based on probability distributions, as described below in greater detail, each subsequent action determined from the output of each pseudo random number generator for each listing is independent of any underlying threading model for managing the load across all active listings. Each of these separate pseudo random number generators is seeded by default with its own genuine random number provided by API calls specific to the platform where the simulator is running, so that the resulting sequence of actions will be different each time the simulator is started.

The frequency of random generation of orders is almost entirely dependent on Listings → randomOrdersRate. The primary setting controls the number of actions taken by the random order generator per second, including the resulting actions taken on resting orders (placing them, and amending or canceling them), as well as the frequency of matching orders resulting in trades. Some other settings, such as Venues → randomPartyCount and Listings → randomDepthLevels would also have some effect, but not as significant as randomOrdersRate.

The value entered for randomOrdersRate determines the frequency with which a timer will trigger in the market simulator to do an action. The specific action taken is randomly chosen each time by a statistically correct, evenly distributed random number generator.

There is a hard-coded 1/3 probability of the simulator choosing to "do nothing" as an action, therefore the effective applied frequency of choosing a random action (including "do nothing") is:

Actual Effective Random Action Frequency = (Configured randomOrdersRate value * 3 ) / 2

Of actual actions taken, there is a hard-coded probability distribution of:

40% probability of resting bid action

40% probability of resting ask action

10% probability of aggressive buy

10% probability of aggressive sell

That means that 80% of the time we should have an action on a resting order in the book, and 20% of the time we should have an action of an aggressive order that may match against a resting order in the book. Note however, aggressive orders will not be sent against an empty side of a book with no corresponding resting orders.

Venues → randomPartyCount value determines the number of counter parties that will be used to determine which party each order action is generated from, and each party is chosen using a simple round-robin choice of parties for each subsequent random action.

For example, if a value of randomPartyCount = 10 is configured, party #1 will be used for the first random action, party #2 will be used for the next action, and so on until we get to party #10 and then return back to party #1 and keep repeating.

Coming back to the probability of order actions, if the random action chosen is a resting bid (40% probability) or ask (40% probability) action, we then have an additional random choice of actions determined by the following logic and hard-coded probability distribution:

If a bid does not exist for a resting bid action (or an ask does not exist for a resting ask action) for the current counter party (as determined by the Venues → randomPartyCount setting described above), then simply place the new bid (or place the new ask). Otherwise, if there is already an existing resting bid (or ask) for the current counter party, use the following probability distribution:

45% probability of amend quantity of existing order

45% probability of amend price of existing order

10% probability of cancel existing order

So in summary, there is an 80% probability each second of performing an action on a resting order (either placing a new order for the party, otherwise 90% probability of amending, or 10% probability of canceling), and a 20% probability each second of performing an aggressive action (matching orders in the book, resulting in trades).

Coming back to our example of randomOrdersRate = 10, this should result in an average of about 8 resting order actions per second (new if no existing order for the party, otherwise about 7 amends, and about 1 cancel) and an average of about 2 matching order trades per second.

While randomOrdersRate is the primary setting determining frequency of actions taken by the simulator, another setting Listings → randomDepthLevels is worth noting. This determines the number of allowed depth levels in the book, such that if the random chosen action is to place a new resting bid or ask for the current counter party, it will not be done if it would mean exceeding this configured maximum number of levels in the book. Combined with the probability distribution of quantity and price as described in the following sections, this maximum number of depth levels could also limit the number of times there is an existing order in the book for a given counter party to perform amend or cancel actions on, and could also limit the range of quantity and price levels available for aggressive orders to match against. The deeper the book is allowed to grow, the closer the simulator will be able to apply the probabilities described above, without synthetically blocking an action due to a limit in the number of depth levels in the book.

Distribution of Price

The price used on randomly generated orders is largely determined by the configuration of Listings → randomOrdersSpread to determine the minimum bid/ask spread to maintain, and Listings → randomTickRange to determine the range which prices are distributed across multiple depth levels of the order book.

The setting Listings → randomOrdersSpread is expressed as an absolute decimal price value, with an enforced minimum of the value of Listings → tickSize configured for the same listing. This effectively becomes the smallest spread allowed in the order book determined by generation of random orders. If the spread becomes less than this value (or crossed) it is likely due to other actions, such as historical data playback or manually entered orders.

Starting with an empty book, the initial value to consider when generating a new random price will be taken from a starting "seed" price as stored in a table of starting prices per instrument (across all listings of that instrument). After the book has resting orders, the initial value is taken from the best prices in the book. In both cases, the initial value is adjusted to incorporate the configured spread as described above. Specifically, prices for new resting Bid orders and aggressive Sell orders use an initial starting value of the best Ask price in the order book subtracting the configured spread, or the best Bid price directly if there are no resting Ask orders, or failing that the configured Bid price directly from the table of starting prices (or Mid price if there is no Bid). Respectively, prices for new resting Ask orders and aggressive Buy orders use an initial starting value of the best Bid price in the order book adding the configured spread, or the best Ask price directly if there are no resting Bid orders, or failing that the configured Bid price directly from the table of starting prices (or Mid price if there is no Ask).

Once this initial price value is determined, the setting Listings → randomTickRange is used to determine the number of ticks by which to vary the price of random orders relative to the starting value. New resting Bid order prices and aggressive Sell order prices are randomly chosen as a number of ticks below the initial value, and new resting Ask order prices and new aggressive Buy order prices are randomly chosen as a number of ticks above the initial value. The frequency distribution of random prices across this range of prices is exponentially weighted by a factor of 1.05 ^ (randomTickRange - 1) so that more orders are placed near the top of the book than lower down.

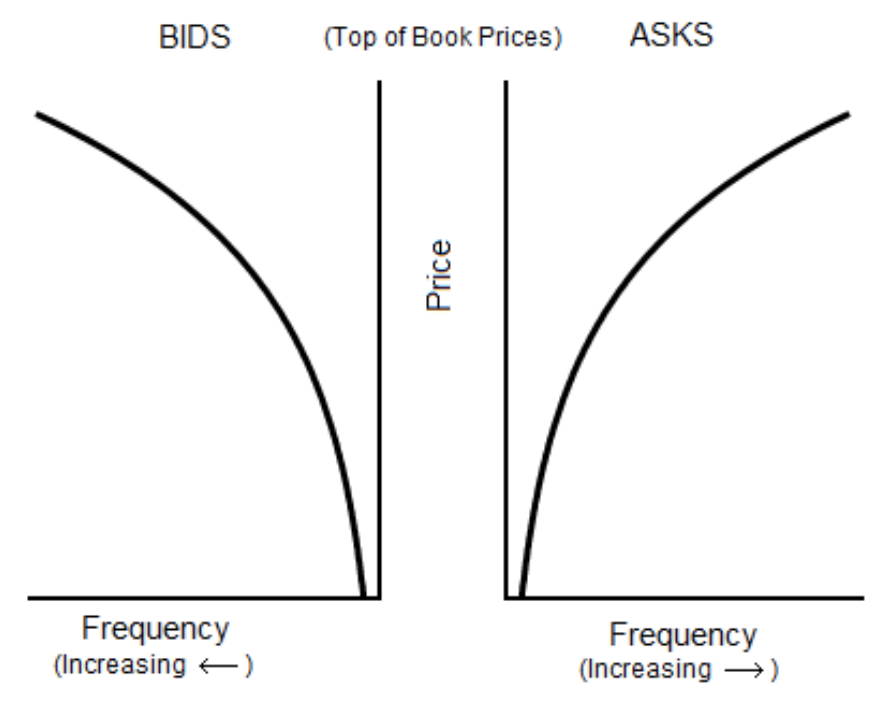

The following diagram represents this distribution:

The final price of a new random order is chosen as a number of ticks away from the initial price value, weighted by the frequency distribution as described above. In this way, the final price is a multiple of the configured ticks on the listing (Listings → PriceTickSize), rounded to the configured precision of the listing (Listings → PricePrecision).

Distribution of Quantity

The quantity used on randomly generated orders is determined by the configuration of minimum and maximum values of either quantity or amount per each listing.

If the setting Listings → randomAmtMinimum is not set, then the value Listings → randomQtyMinimum is used as the lowest possible quantity value (or instead qtyMinimum if that is larger than randomQtyMinimum or randomQtyMinimum is not set). If the setting Listings → randomAmtMinimum is set, then this value divided by the determined random price (per the section above) is used as the lowest possible quantity value (or instead Listings → randomQtyMinimum if that is set and is larger than the minimum quantity determined from randomAmtMinimum, or again instead qtyMinimum if that is larger than the minimum quantity determined from randomAmtMinimum and randomQtyMinimum if it is set). This lowest possible quantity value is then rounded up to the nearest multiple of the setting Listings → qtyMultiple.

Likewise, if the setting Listings → randomAmtMaximum is not set, then the value Listings → randomQtyMaximum is used as the highest possible quantity value (or instead qtyMaximum if that is smaller than randomQtyMaximum or randomQtyMaximum is not set). If the setting Listings → randomAmtMaximum is set, then this value divided by the determined random price (per the section above) is used as the highest possible quantity value (or instead Listings → randomQtyMaximum if that is set and is smaller than the maximum quantity determined from randomAmtMaximum, or again instead qtyMaximum if that is smaller than the maximum quantity determined from randomAmtMaximum and randomQtyMaximum if it is set). This highest possible quantity value is then rounded down to the nearest multiple of the setting Listings → qtyMultiple.

If the settings Listings → randomAggQtyMinimum / randomAggQtyMaximum / randomAggAmtMinimum / randomAggAmtMaximum are set, then these values are used instead for aggressive orders, and the other corresponding settings described above are used only for passive orders.

Once the lowest and highest possible quantity values are determined, the quantity of random order actions is generated as an integer between these values, rounded to the nearest multiple of the setting Listings → qtyMultiple.

Special Market Events

Documentation TBC (controlling high volatility, spikes, market impact, etc.).

Data Source Playback

The market simulator can read data from an external data source and play it back through the main order book of the simulator to allow clients to consume this as tradable market data. For instance, a data source with bid/ask market data is turned into orders that are sent into the simulator’s matching engine, which then results in published market data and the ability for other clients to send orders into the same matching engine’s order book.

The market simulator currently supports either CSV file format or databases such as PostgreSQL and TimescaleDB. The simulator can read market data in the form of multiple bid/ask order book levels.

See this section for specific details of configuring data sources.

Format Specific Configuration

CSV Files

The connection string for a CSV file is the full absolute local file path to the file containing data. For example: “/path/to/my/file.csv”

Following usual CSV standards:

-

Numeric values are expected to be specified with a decimal point for fractional amounts. e.g. 3 or 3.45

-

Strings can be specified without double quotes (") if they have no spaces, otherwise if spaces are present the string should be surrounded by double quotes ("). e.g. abc or "a b c"

-

If a string is surrounded by double quotes and it contains a double quote, it must be escaped by using 2 double quotes. e.g. "a b "" c" for the string a b " c

-

Either a Unix or Windows style end of line can be used for each row.

An additional point is that currently all Date/Time strings are expected to be specified in the format: "YYYY-MM-DD HH:MM:SS.MMM"

The following data source properties can be configured to indicate aspects specific to the format of a CSV file:

-

textDelimeter - delimiter used to separate values ("," by default if not specified)

-

textHeaderRow - 1-based row index of where header row is located (0 indicates no header row)

-

textDataRow - 1-based row index of where the first row of data is located. Cannot be 0, and must be greater than

textHeaderRow

Specifically for CSV format files, and only when textHeaderRow is 0 or not specified, the column mapping properties of the data source can be used to map columns by index number. The columnTo property of the column mapping can be used to specify a 1-based column number to map to in the data source. In this case, if no column mappings are indicated, the following default order of columns is expected:

ReceivedTimeStamp, MessageTimeStamp, Instrument, BidParty, BidQuantity, BidPrice, AskPrice, AskQuantity, AskParty

Also in this case, if some columns are mapped but not others, any unmapped column is assumed to be at the position as indicated above by the default order of columns.

The following examples show sample generic CSV formats using these data source properties:

textDelimiter absent / textHeaderRow=1 / textDataRow=2

col1,col2,col3,col4,col5,col6,col7 "2019-03-07 15:00:00.243",value1,"value 2","value "" 3",1,2,3 "2019-03-07 15:01:05.876",value4,"value 5","value "" 6",4,5,6

textDelimiter=; / textHeaderRow=2 / textDataRow=4

col1,col2,col3,col4,col5,col6,col7 "2019-03-07 15:00:00.243";value1;"value 2";"value "" 3";1;2;3 "2019-03-07 15:01:05.876";value4;"value 5";"value "" 6";4;5;6

textDelimiter absent / textHeaderRow=0 / textDataRow=1

"2019-03-07 15:00:00.243",value1,"value 2","value "" 3",1,2,3 "2019-03-07 15:01:05.876",value4,"value 5","value "" 6",4,5,6

Databases

The connection string for a database is the URL containing the IP, port, authentication details, and database name required to connect to the database instance. For example: “postgresql://myuser:mypassword@10.0.1.1:5432/mydatabasename”

The following data source properties can be configured to indicate aspects specific to the format of a database:

-

tableName - name of table containing data in the database

Basic Single Level Order Book

For a simple data source where each row contains only a single level bid/ask order book, the simulator starts reading the single level of depth from the first row of the datasource, and then proceeds to read each subsequent row after that. The trigger for playing back the content of a data source follows the same logic as the configuration used to indicate whether or not to generate random orders. The orderOnStartup property of a venue determines whether to play back any configured data sources when the simulator starts, and the genstart REST API can be used to start play back on demand. If the randomOrdersEnabled property of a listing is true, then both random order generation and playback from a configured data source will begin and continue to run simultaneously.

In processing each data source row, the simulator compares the current state of the matching engine for the given listing of each row, and generates a series of order actions (new orders, amends, cancels) to modify the current state of the matching engine to change to a state that matches the values from the current data source row being processed. The following logic is applied to derive order actions from each row of a data source:

-

Any existing orders from counter parties that do not match the party of the data source row being processed are canceled.

-

Any existing orders for the same party as the data source row being processed without a corresponding bid or ask entry in the data source are canceled.

-

Any existing orders for the same party as the data source row being processed with a corresponding bid or ask entry in the data source are amended to the same price and quantity as the corresponding bid or ask entry in the data source.

-

Any bid or ask entries in the data source without a corresponding existing order for the same party results in a new order with the properties of that bid or ask entry in the data source.

This will result in all of the usual market data updates generated when any order actions are sent into the matching engine. Each row of the datasource is played back into the matching engine at a rate that corresponds with the ReceivedTimeStamp property of the row. The first row will be played back immediately, the second row will be played back with a delay of the difference between the ReceivedTimeStamp of the second and first rows, and so on. This continues until the last row of the data source, at which point if the repeat property of the venue is false, then play back will stop, otherwise if it is true the simulator will continue to play back the content of the data source restarting from the first row.

The order actions derived from each data source row processed by the simulator use the bid and ask party, quantity, and price values to update the state of the matching engine. While ReceivedTimeStamp is used only to determine when the order actions are played back into the matching engine, the MessageTimeStamp is used to set the timestamp property (generally set by the sender) of each order action. The MessageTimeStamp property value used to set the timestamp on each order action is adjusted with the difference between the ReceivedTimeStamp of the first row and the current time of day at that moment.

For example, if the following 2 first rows from a data source were being played back at a current time of day of 14:30:00.500 :

ReceivedTimeStamp,MessageTimeStamp,... "2019-03-07 15:00:00.243","2019-03-07 15:00:00.115",... "2019-03-07 15:01:05.876","2019-03-07 15:01:05.203",...

…then the resulting order actions would be played back at the following times, with the following timestamps:

@ 14:30:00.500 : timestamp = 14:30:00.372

@ 14:31:06.133 : timestamp = 14:31:05.460

| Note that the simulator will play back order actions with at least the same delay between values of ReceivedTimeStamp for each row, though the actual delay may be longer if the simulator is unable to play back the order actions for each row for too small of a specified delay. |

For database format and CSV file format with a non-zero textHeaderRow value, the column mapping properties of the data source can be used to map columns by name. The columnFrom property of the column mapping is used to select the internal simulator field that will be mapped from, and the columnTo property indicates the data source column that the simulator field will be mapped to. In this case, any unmapped columns are assumed to use the same values as available for the columnFrom property as the column name in the data source.

See the section Market Simulator REST API | Column Mapping Sub List for descriptions of all possible fields that can be mapped from a data source as configured using the columnFrom property of a data source column mapping. If any bid or ask level is missing a price or quantity value, that bid or ask entry is considered to be empty and removed from the state of the matching engine. If the party value for a bid or ask level is missing, a default value of “CP1” is used for data sources with a single level bid/ask order book.

The following shows a sample data source list of single level bid/ask order books, which can be interpreted either as a CSV or database format.

ReceivedTimeStamp,MessageTimeStamp,Instrument,BidParty,BidQuantity,BidPrice,AskPrice,AskQuantity,AskParty "2019-03-07 15:00:00.243","2019-03-07 15:00:00.115","VOD.L",CP1,10,133.50,134.85,15,CP2 "2019-03-07 15:01:05.876","2019-03-07 15:01:05.203","VOD.L",CP1,10,133.50,135.83,15,CP2 "2019-03-07 15:01:14.667","2019-03-07 15:01:13.998","VOD.L",CP1,8,133.50,135.70,18,CP2

Multiple Level Order Book

For a more complex data source where each row contains a bid/ask order book with more than one level, the simulator processes each row much like as described above for a single level order book, but changing the state of the matching engine to have the multiple bid/ask levels indicated by each row of the data source.

The column mapping properties of the data source can be used to map to multiple simulator fields corresponding to the columnFrom values of BidParty, BidQuantity, BidPrice, AskPrice, AskQuantity, AskParty. For each of these columnFrom values, a 1-based index can be appended to indicate which bid or ask level that value should be applied to, for example BidParty1 for the first bid level, BidParty2 for the second bid level, and so on. In this case, the columnTo property still works the same way, indicating either the name or (for a CSV file format when textHeaderRow is 0 or not specified) the index position of the data source column to map to. If no column mapping is indicated for one of the columnFrom values listed above, then either for a database format or CSV file format with a non-zero value for textHeaderRow, it is expected that column names are specified in the data source, and if that unmapped column name (from the list of BidParty, BidQuantity, BidPrice, AskPrice, AskQuantity, AskParty) is not found directly as one of the columns of the data source, then that same column name is expected to be present but with a 1-based index appended to indicate which bid or ask level that column of values should be applied to. For instance, if BidPrice is not specified as a mapped column of the data source, and BidPrice as a column name is not present in the data source, then it is expected that BidPrice1, BidPrice2, etc will be specified as columns in the data source for each level.

If the party value for a bid or ask level is missing for data sources with multiple bid/ask levels, a default value of “CP#” is used, where # is the index for each level (e.g. level 1 would use CP1, etc).

Note that the # character can also be appended to either the columnFrom or columnTo data source column mappings to indicate that all available depth levels can be mapped. For instance a column mapping of columnFrom=BidPrice# and columnTo=bidpx# indicates that a simulator field of BidPrice for level 1 of bids would be mapped to a column name in the data source of bidpx1, and a simulator field of BidPrice for level 2 of bids would be mapped to a column name in the data source of bidpx2, and so on.

It is also possible to limit the number of depth levels processed from a data source using the maxDepthLevels property of a venue. This value can optionally be used to indicate the maximum number of bid/ask levels that will be processed by the simulator in the data source, after which the remaining levels will be ignored and treated as empty.

The following shows a sample data source list of bid/ask order books with multiple (5) levels, some with empty entries, which can be interpreted either as a CSV or database format.

ReceivedTimeStamp,MessageTimeStamp,Instrument,BidParty1,BidQuantity1,BidPrice1,BidParty2,BidQuantity2,BidPrice2,BidParty3,BidQuantity3,BidPrice3,BidParty4,BidQuantity4,BidPrice4,BidParty5,BidQuantity5,BidPrice5,AskPrice1,AskQuantity1,AskParty1,AskPrice2,AskQuantity2,AskParty2,AskPrice3,AskQuantity3,AskParty3,AskPrice4,AskQuantity4,AskParty4,AskPrice5,AskQuantity5,AskParty5 2021-04-08 12:34:00.003,2021-04-08 12:34:00.003,VOW,CP1,500000.0,1.18811,CP2,1000000.0,1.1881,CP3,3000000.0,1.18807,CP4,5000000.0,1.18805,,,,1.18818,1500000.0,CP6,1.18823,3000000.0,CP7,1.18826,5000000.0,CP8,,,,,, 2021-04-08 12:34:10.044,2021-04-08 12:34:10.044,VOW,CP1,1000000.0,1.18812,,,,,,,,,,,,,1.18819,1000000.0,CP6,,,,,,,,,,,, 2021-04-08 12:34:20.048,2021-04-08 12:34:20.048,VOW,CP1,3000000.0,1.18812,CP2,1000000.0,1.18811,CP3,500000.0,1.1881,,,,,,,1.18815,2000000.0,CP6,1.18816,1000000.0,CP7,1.18817,1000000.0,CP8,,,,,,

Market Phases

The market simulator can be configured to operate in the context of specific market phases following a configured schedule. Each phase has distinct rules of operation regarding what type of trading is allowed and how orders are matched.

If any market phases are scheduled according to the startTime and endTime properties of phases configured on a venue, each of the scheduled market phases will become the active market phase between these start and end times during that day, interepreting these times according to the timeZone property configured on the venue. Any phase with the same end time as the start time of the next phase (including 00:00 and 24:00 which are considered as overlapping) will result in the immediate transition from the first phase to the next phase at this common time. If there is a gap in scheduled market phases, and no market phase is scheduled to be currently active, then the default active market phase is the Open phase. Any phase scheduled with a start time after its own end time is considered invalid and ignored.

For any scheduled market phases with overlapping start and end times, the phase scheduled to start within the start and end times of another phase will take priority as the active market phase, and then when it ends, revert to the initial market phase, unless that phase is also now ended. In general, if multiple phases have overlapping start and end times, each new phase with the most recent start time will be considered active at its start time, then at its end time the active phase should revert to the phase with the most recent start time that has not yet reached its end time.

Some examples of this include:

-

If phase1 has a start time and end time between the start time and end time of phase2, then phase1 is active between phase2 being active (phase2 follows phase1 which then reverts back to phase2).

-

If phase1 has a start time between the start time and end time of phase2, and phase1 has an end time greater than the end time of phase2, then phase1 would be active for the last part of phase2 and continue past it (phase2 follows phase1 which then becomes the Open phase if no other phase is scheduled).

See this section for specific details of configuring market phases on venues.

The following indicates details on the operation of each specific phase while it is active.

Open Phase

While the Open market phase is active, all normal trading activity is allowed.

Closed Phase

While the Closed market phase is active, all trading activity is blocked. It is still possible for market sessions to be connected and remain connected, and it is still possible to subscribe to market data updates and remain subscribed to market data updates, but all order action requests will be rejected, such as requests for new orders, amending orders, or canceling orders. In addition, at the moment a Closed phase starts, any existing orders in the matching engine for any listing will be terminated and rejected if they have a Time In Force of Day or Time In Force of GoodTillDate with an expiration of the current day.

Phase Halt

The halting of a phase is not technically a market phase itself, but rather the temporary halt of the currently active market phase. In this state, any order action request sent to the simulator will be rejected.

If a phase halt is explicitly configured as part of the phase schedule, it would only halt phases other than Closed. A Closed phase is always Closed and cannot be halted. A scheduled halt starting before a scheduled Closed phase would become a Closed phase, though a scheduled halt starting before or during a scheduled Closed phase that ends after the end of the Closed phase would then become a halt of the active phase following the Closed phase.

If a phase halt is triggered on demand through a halt request, it will halt the currently active market phase. However, if the request to halt a phase is made before a scheduled halt, the start of the scheduled halt would override the requested halt, such that the end of the scheduled halt would once again resume the currently active market phase.

For either a scheduled or requested halt of the currently active market phase, the property allowCancels in the scheduled halt or in the halt request indicates whether the halted phase would reject only new order and amend order requests, or also reject order cancel requests. In this way, if allowCancels is true, a halted phase may still process order cancel requests.

A currently halted phase can also be removed on demand through a resume request to reactive the otherwise currently active scheduled market phase.

Persisted State

The market simulator may store and recover:

-

The order book;

-

The last trade;

-

Low and high trade prices.

The settings persistenceEnabled and persistenceFilePath are used to configure the feature - if persistenceEnabled is true:

-

The market simulator recovers its state from the file placed at persistenceFilePath on startup or by request Market Simulator REST API | Recover Market State For Single Venue ;

-

The market simulator stores its state on clean shutdown or by request Market Simulator REST API | Store Market State For Single Venue.

If the file’s content is correct JSON and the instrument is found, the order book, last trade, and low and high trade prices will be removed during the recovery.

File Format

The data is stored in the JSON file.

For instance, the venue “LSE” contains two listings “AAPL” and “VOW”:

-

“AAPL” has no orders in the order book, no last trade, and low and high prices.

-

“VOW” has the last trade, low and high prices. Its order book contains one buy order and two sell orders.

{

"venue_id": "LSE",

"instruments": [

{

"instrument": {

"symbol": "AAPL",

"price_currency": "USD",

"base_currency": null,

"security_exchange": "XLOM",

"party_id": null,

"cusip": null,

"sedol": "B0YQ5W0",

"isin": "US0378331005",

"ric": null,

"exchange_id": null,

"bloomberg_id": null,

"price_tick": 0.1,

"quantity_tick": 1.0,

"min_quantity": 1.0,

"max_quantity": 10000.0,

"party_role": null,

"security_type": "CommonStock"

},

"last_trade": null,

"info": null,

"order_book": {

"buy_orders": [],

"sell_orders": []

}

},

{

"instrument": {

"symbol": "VOW",

"price_currency": "EUR",

"base_currency": null,

"security_exchange": "XLOM",

"party_id": null,

"cusip": null,

"sedol": "0308908",

"isin": "DE0007664005",

"ric": null,

"exchange_id": null,

"bloomberg_id": null,

"price_tick": 0.00001,

"quantity_tick": 1.0,

"min_quantity": 1.0,

"max_quantity": 1000000000.0,

"party_role": null,

"security_type": "CommonStock"

},

"last_trade": {

"buyer": "CP3",

"seller": "CP6",

"trade_price": 1.18815,

"traded_quantity": 290.0,

"aggressor_side": "Buy",

"trade_time": "2025-05-16 14:42:49.958327",

"market_phase": {

"trading_phase": "Open",

"trading_status": "Resume"

}

},

"info": {

"low_price": 1.18812,

"high_price": 1.18818

},

"order_book": {

"buy_orders": [

{

"client_instrument_descriptor": {

"security_id": "DE0007664005",

"symbol": "VOW",

"currency": "EUR",

"security_exchange": "XLOM",

"parties": [],

"requester_instrument_id": 1,

"security_type": "CommonStock",

"security_id_source": "ISIN"

},

"client_session": {

"type": "Generator",

"fix_session": null

},

"client_order_id": "SIM-1747406520164373224",

"order_parties": [

{

"identifier": {

"party_id": "CP1",

"source": "Proprietary"

},

"role": "ExecutingFirm"

}

],

"expire_time": null,

"expire_date": null,

"short_sale_exemption_reason": null,

"time_in_force": "Day",

"order_id": 250516144244000013,

"order_time": "2025-05-19 14:42:48.614534",

"side": "Buy",

"order_status": "Modified",

"order_price": 0.38799,

"total_quantity": 3000000.0,

"cum_executed_quantity": 1000535.0

}

],

"sell_orders": [

{

"client_instrument_descriptor": {

"security_id": "DE0007664005",

"symbol": "VOW",

"currency": "EUR",

"security_exchange": "XLOM",

"parties": [],

"requester_instrument_id": 1,

"security_type": "CommonStock",

"security_id_source": "ISIN"

},

"client_session": {

"type": "Fix",

"fix_session": {

"begin_string": "FIXT.1.1",

"sender_comp_id": "SENDER",

"target_comp_id": "TARGET",

"client_sub_id": null

}

},

"client_order_id": "SIM-1747406520164373237",

"order_parties": [

{

"identifier": {

"party_id": "CP5",

"source": "Proprietary"

},

"role": "ExecutingFirm"

}

],

"expire_time": null,

"expire_date": null,

"short_sale_exemption_reason": null,

"time_in_force": "Day",

"order_id": 250516144250000026,

"order_time": "2025-05-16 14:42:51.522018",

"side": "Sell",

"order_status": "Modified",

"order_price": 1.188,

"total_quantity": 408.0,

"cum_executed_quantity": 0.0

},

{

"client_instrument_descriptor": {

"security_id": "DE0007664005",

"symbol": "VOW",

"currency": "EUR",

"security_exchange": "XLOM",

"parties": [],

"requester_instrument_id": 1,

"security_type": "CommonStock",

"security_id_source": "ISIN"

},

"client_session": {

"type": "Generator",

"fix_session": null

},

"client_order_id": "SIM-1747406520164373236",

"order_parties": [

{

"identifier": {

"party_id": "CP8",

"source": "Proprietary"

},

"role": "ExecutingFirm"

}

],

"expire_time": null,

"expire_date": null,

"short_sale_exemption_reason": null,

"time_in_force": "Day",

"order_id": 250516144250000025,

"order_time": "2025-05-16 14:42:50.627388",

"side": "Sell",

"order_status": "Modified",

"order_price": 1.18812,

"total_quantity": 606.0,

"cum_executed_quantity": 0.0

}

]

}

}

]

}Data verification

On storing, the market simulator does the following verifications:

| Verification | Actions if fail | |

|---|---|---|

1 |

persistenceEnabled is true |

Output log info message: "The market state was not stored: the persistence is disabled." Stop storing. |

2 |

persistenceFilePath is not empty |

Output log error message: "The market state was not stored: the persistence file path is empty." Stop storing. |

3 |

The directory of the persistence file exists |

Output log error message: "The market state was not stored: the persistence file path directory does not exist." Stop storing. |

4 |

The file can be saved |

Output log error message: "The market state was not stored: an error when unable to open file." Stop storing. |

On recovery, the market simulator does the following verifications:

| Verification | Actions if fail | |

|---|---|---|

1 |

persistenceEnabled is true |

Output log info message: "The market state was not recovered: the persistence is disabled." Stop the recovery |

2 |

persistenceFilePath is not empty |

Output log info message: "The market state was not recovered: the persistence file path is empty." Stop the recovery. |

3 |

persistenceFilePath contains the path to the existing file |

Output log info message: "The market state was not recovered: the persistence file path is unreachable." Stop the recovery. |

4 |

The file was successfully opened |

Output log error message: "The market state was not recovered: an error when unable to open file." Stop the recovery. |

5 |

The file content was successfully parsed |

Output log error message: “The market state was not recovered: the persistence file is malformed: {}", where “{}” is a placeholder for details. Stop the recovery. |

6 |

The instrument is found and enabled. The equality of the following fields is used to check that the parsed instrument is present and enabled in the venue:

If the instrument is found, all orders from its order book will be cancelled. |

Output log warning message: "The instrument was not found, its recovery was ignored: {}", where “{}” is a placeholder for the instrument. Move on to the next instrument. |

7 |

If the market phase is Closed, the order’s |

Output log error message: “validation failed with 'the order is already expired because its time_in_force is Day and the market phase is Closed' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

8 |

The order’s |

Output one of the log error messages:

where “{}” is a placeholder for the order. Move on to the following order. |

9 |

If the order is in the “buy_orders” list, the order’s |

Output log error message: “validation failed with 'invalid side value' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

10 |

If the order is in the “sell_orders” list, the order’s |

Output log error message: “validation failed with 'invalid side value' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

11 |

The order’s |

Output log error message: “validation failed with 'total quantity minimal constraint violated' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

12 |

The order’s |

Output log error message: “validation failed with 'total quantity maximal constraint violated' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

13 |

The order’s |

Output log error message: “validation failed with 'total quantity multiple constraint violated' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

14 |

The order’s |

Output log error message: “validation failed with 'cumulative executed quantity is less than zero' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

15 |

The order’s |

Output log error message: “validation failed with 'cumulative executed quantity multiple constraint violated' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

16 |

The order’s |

Output log error message: “validation failed with 'cumulative executed quantity is not less than total quantity' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

17 |

The order’s |

Output log error message: “validation failed with 'order price tick constraint violated' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

18 |

The order’s |

Output log error message: “validation failed with 'unsupported order status value' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

19 |

The order’s |

Output log error message: “validation failed with 'time in force value is invalid' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

20 |

If the order’s |

Output log error message: “validation failed with 'order already expired' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

21 |

If the order’s |

Output log error message: “validation failed with 'neither expire date nor expire time specified' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

22 |

If the order’s |

Output log error message: “validation failed with 'order already expired' error, order was not recovered: {}”, where “{}” is a placeholder for the order. Move on to the following order. |

23 |

The |

Output log warning message: ”last trade is empty, nothing to validate” Remove the information about the last trade from the instrument. Then move on to low and high trade prices. |

24 |

The |

Output log error message: “validation failed with 'trade price tick constraint violated' error, last trade was not recovered: {}”, where “{}” is a placeholder for the Move on to low and high trade prices. |

25 |

The |

Output log error message: “validation failed with 'traded quantity multiple constraint violated' error, last trade was not recovered: {}”, where “{}” is a placeholder for the Move on to low and high trade prices. |

26 |

The |

Output log error message: “validation failed with 'minimal traded quantity constraint violated' error, last trade was not recovered: {}”, where “{}” is a placeholder for the Move on to low and high trade prices. |

27 |

The |

Output log error message: “validation failed with 'maximal traded quantity constraint violated' error, last trade was not recovered: {}”, where “{}” is a placeholder for the Move on to low and high trade prices. |

28 |

The |

Output log warning message: ”info is empty, nothing to validate” Remove the information about the low and high prices from the instrument. Move on to the following instrument. |

29 |

The |

Output log error message: “validation failed with 'low price tick constraint violated' error, instrument info was not recovered: {}”, where “{}” is a placeholder for the Move on to the following instrument. |

30 |

The |

Output log error message: “validation failed with 'high price tick constraint violated' error, instrument info was not recovered: {}”, where “{}” is a placeholder for the Move on to the following instrument. |

31 |

The |

Output log error message: “validation failed with 'low price is less than or equal to high price constraint violated' error, instrument info was not recovered: {}”, where “{}” is a placeholder for the |

Administrative Settings

General Settings

Manage general settings across all market simulator instances.

| Path | Type | Description |

|---|---|---|

key |

Text |

Unique primary key |

value |

Text |

Value of setting |

A list of settings, currently defined in the Market Simulator backend:

| Setting | Key | Meaning |

|---|---|---|

System Display Name |

DisplayName |

The name of the site for display purposes |

Price Seed Values Database Connection |

SeedPriceDatabaseConnection |

Connection string to a PostgreSQL database to synchronize price seeds |

Price Seed Values Last Update |

SeedPricesLastUpdated |

Last time when price seeds were synchronised |

Market Simulator REST backend allows a user to retrieve general settings and update them. There is no possibility to create a new setting or drop an existing one via the REST API.

Get Settings

Request all market simulator general settings.

Resource URI

GET /api/settings

Example: Request all settings

GET /api/settings HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhostExample: Possible response

HTTP/1.1 200 OK

Connection: Close

Content-Length: XXX

{

"settings" : [

{

"key":"DisplayName",

"value":"SITE NAME"

},

{

"key" : "SeedPriceDatabaseConnection",

"value" : "postgresql://user:password@1.2.3.4:1234/simdb"

},

{

"key" : "SeedPricesLastUpdated",

"value" : "2023-09-07 12:34:55"

}

]

}Update Settings

Update Market Simulator general setting values.

Resource URI

PUT /api/settings

Example: Update settings

PUT /api/settings/DisplayName HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhost

{

"settings" : [

{

"key":"DisplayName",

"value":"MKTSIMULATOR-DEV"

},

{

"key" : "SeedPriceDatabaseConnection",

"value" : "postgresql://user:pass@1.2.3.4:1234/simdb"

}

]

}Example: Positive reply

HTTP/1.1 200 OK

Connection: Close

Content-Length: XXX

{

"result" : "General settings updated successfully"

}Example: Negative reply

HTTP/1.1 400 Bad Request

Connection: Close

Content-Length: XXX

{

"result" : "Unknown BadKey setting update requested"

}| SeedPricesLastUpdated is considered as read-only to a user. It can be updated by the MarketSimulator BE itself only, and will be ignored if included in the settings update request. |

Venues

Manage settings for each market simulator venue entity.

Resource Properties

| Path | Type | Description |

|---|---|---|

id |

Text |

Unique primary key |

name |

Text |

Display name |

engineType |

Enum |

Indicates which type of engine we want to use for this venue (Currently only matching engine is available)

|

supportTifIoc |

Boolean |

Whether IOC limit orders are supported |

supportTifFok |

Boolean |

Whether FOK limit orders are supported |

supportTifDay |

Boolean |

Whether Day limit orders are supported |

includeOwnOrders |

Boolean |

Whether to include a party’s own orders in published depth |

restPort |

Integer |

The port that will be used to send REST API calls |

orderOnStartup |

Boolean |

Whether to start generating orders when MktSimulator launched |

randomPartyCount |

Integer |

The amount of different counter party id’s used by generator |

timeAndSalesEnabled |

Boolean |

Whether time and sales trades should be included at all in market data updates |

timeAndSalesQuantityEnabled |

Boolean |

Whether time and sales trades should include quantity of the trade |

timeAndSalesSideEnabled |

Boolean |

Whether time and sales trades should include side of the trade |

timeAndSalesPartiesEnabled |

Boolean |

Whether time and sales trades should include counter parties of the trade |

timeZone |

Text |

Local time zone for a venue (f.e. Europe/Kyiv or America/Los_Angeles) For reference: https://en.wikipedia.org/wiki/List_of_tz_database_time_zones |

cancelOnDisconnect |

Boolean |

If a client’s FIX connection disconnects:

|

persistenceEnabled |

Boolean |

Whether a matching engine persisted state functionality should be enabled |

persistenceFilePath |

Text |

A file path to the persistence file where matching engine state should be stored/recovered |

Market Phases Sub-List

| Path | Type | Description |

|---|---|---|

phase |

Text |

Enum value from a pre-defined list of supported values:

|

startTime |

Text |

The time a phase should begin set in corresponding venue timezone, specified to the granularity of minutes |

endTime |

Text |

The time a phase should end set in corresponding venue timezone, specified to the granularity of minutes |

endTimeRange |

Integer |

Time range to choose a random actual end time from the specified endTime for the phase (this setting is only used during an Auction phase). The value indicates the range after and before that a random end time will be chosen. For example, a value of 5 indicates that a random end time will be chosen between 5 minutes before and 5 minutes after the specified endTime. |

allowCancels |

Boolean |

Whether or not to allow cancel of orders (this setting is only used during a Halt phase). |

Get Single Venue

Request a single market simulator venue entity.

Resource URI

GET /api/venues/{venueId}

Example: Request single venue

GET /api/venues/LSE HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhostExample: Positive reply

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: XXX

{

"id" : "LSE",

"name" : "London Stock Exchange",

"engineType" : "Matching",

"supportTifIoc" : true,

"supportTifFok" : true,

"supportTifDay" : true,

"includeOwnOrders" : true,

"restPort":9184,

"orderOnStartup" : false,

"randomPartyCount" : 10,

"timeAndSalesEnabled" : true,

"timeAndSalesQuantityEnabled" : true,

"timeAndSalesSideEnabled" : true,

"timeAndSalesPartiesEnabled" : true,

"timezone" : "America/Los_Angeles",

"cancelOnDisconnect" : false,

"persistenceEnabled" : true,

"persistenceFilePath" : "/path/to/LSE-state.json"

"phases" : [

{

"phase" : "Open",

"startTime" : "07:39:00",

"endTime" : "07:39:00",

"endTimeRange" : 0

},

{

"phase" : "Closed",

"startTime" : "09:27:00",

"endTime" : "09:28:00",

"endTimeRange" : 0

}

]

}Example: Negative reply

HTTP/1.1 404 Not Found

Connection: Close

Content-Length: XXX

{

"result" : "No such venue"

}Get Multiple Venues

Request all market simulator venue entities.

Resource URI

GET /api/venues

Example: Request all venues

GET /api/venues HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhostExample: Possible response

HTTP/1.1 200 OK

Connection: Close

Content-Length: XXX

{

"venues": [

{

"id": "FASTMATCH",

"name": "FASTMATCH",

"engineType": "Quoting",

"supportTifIoc": true,

"supportTifFok": true,

"supportTifDay": true,

"includeOwnOrders": true,

"restPort": 9182,

"orderOnStartup": false,

"randomPartyCount": 10,

"timeAndSalesEnabled": true,

"timeAndSalesQuantityEnabled": true,

"timeAndSalesSideEnabled": true,

"timeAndSalesPartiesEnabled": true,

"timezone" : "America/Los_Angeles",

"cancelOnDisconnect": false,

"persistenceEnabled" : false,

"phases": []

},

{

"id" : "LSE",

"name" : "London Stock Exchange",

"engineType" : 1,

"supportTifIoc" : true,

"supportTifFok" : true,

"supportTifDay" : true,

"includeOwnOrders" : true,

"restPort":9184,

"orderOnStartup" : false,

"randomPartyCount" : 10,

"timeAndSalesEnabled" : true,

"timeAndSalesQuantityEnabled" : true,

"timeAndSalesSideEnabled" : true,

"timeAndSalesPartiesEnabled" : true,

"timezone" : "America/Los_Angeles",

"cancelOnDisconnect" : false,

"persistenceEnabled" : true,

"persistenceFilePath" : "/path/to/LSE-state.json"

"phases" : [

{

"phase" : "Open",

"startTime" : "07:39:00",

"endTime" : "07:39:00",

"endTimeRange" : 0

},

{

"phase" : "Closed",

"startTime" : "09:27:00",

"endTime" : "09:28:00",

"endTimeRange" : 0

}

]

}

]

}Add Venue

Add new market simulator venue entity.

Resource URI

POST /api/venues

Example: Add venue

POST /api/venues HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhost

Content-Length: XXX

{

"id" : "NewExchange",

"name" : "NewExchange Description",

"engineType" : "Matching",

"supportTimeInSales" : false,

"supportTifIoc" : false,

"supportTifFok" : false,

"supportTifDay" : false,

"includeOwnOrders" : false,

"restPort" : 9087,

"orderOnStartup" : true,

"randomPartyCount" : 1

}Example: Positive reply

HTTP/1.1 200 OK

Connection: Keep-Alive

Content-Length: XXX

{

"result" : "Requested insert of the venue - NewExchange"

}Example: Negative reply

HTTP/1.1 400 Bad Request

Connection: Close

Content-Length: XXX

{

"result" : "There is already such venue"

}Update Venue

Update existing market simulator venue entities.

Resource URI

PUT /api/venues/{venueId}

Example: Update Venue

POST /api/venues/NewExchange HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhost

Content-Length: XXX

{

"randomOrdersRate" : 12,

"orderOnStartup" : true

}Example: Positive reply

HTTP/1.1 200 OK

Connection: Close

Content-Length: XXX

{

"result" : "Requested update of the venue - NewExchange"

}Example: Negative reply

HTTP/1.1 404 Not Found

Connection: Close

Content-Length: XXX

{

"result":"No such venue"

}Delete Single Venue

It is not allowed to delete venues using the REST API.

Listings

Manage settings for specific listings on each market simulator instance.

Resource Properties

| Path | Type | Description |

|---|---|---|

id |

Numeric |

Unique primary key |

symbol |

Text |

The symbol for this listing, unique to the venue |

venueId |

Text |

Unique venue key for this listing |

securityType |

Text |

Security type for this listing, possible values are:

|

priceCurrency |

Text |

Currency of price (for FX, second currency in the pair) |

fxBaseCurrency |

Text |

For FX only, first currency in the pair, representing current of quantity |

instrSymbol |

Text |

A common symbol used for this listing across different venues |

securityExchange |

Text |

Exchange name to indicate where a listing is traded |

partyId |

Text |

Additional value to indicate where a listing is traded |

partyRole |

Text |

Additional value to indicate where a listing is traded |

cusipId |

Text |

CUSIP instrument/listing identifier |

sedolId |

Text |

SEDOL instrument/listing identifier |

isinId |

Text |

ISIN instrument/listing identifier |

ricId |

Text |

RIC instrument/listing identifier |

exchangeSymbolId |

Text |

Custom Exchange listing identifier |

bloombergSymbolId |

Text |

Bloomberg instrument/listing identifier |

qtyMinimum |

Decimal |

The minimum allowed order quantity (0 by default, though all orders require >0 quantity) |

qtyMaximum |

Decimal |

The maximum allowed order quantity (no limit by default) |

qtyMultiple |

Decimal |

Required even multiple of order quantity (any multiple by default) |

priceTickSize |

Decimal |

Required even multiple of order price (any multiple by default) |

randomQtyMinimum |

Decimal |

The minimum quantity that can be created by the Random Order Generator (uses qtyMinimum by default or if qtyMinimum has a higher value) Used only for passive orders if randomAggQtyMinimum and/or randomAggAmtMinimum have a value. |

randomQtyMaximum |

Decimal |

The maximum quantity that can be created by the Random Order Generator (uses qtyMaximum by default or if qtyMaximum has a lower value) Used only for passive orders if randomAggQtyMaximum and/or randomAggAmtMaximum have a value. |

randomAmtMinimum |

Decimal |

The amount used to derive the minimum quantity that can be created by the Random Order Generator (uses randomQtyMinimum by default or if randomQtyMinimum has a higher value than the quantity derived from this value) Used only for passive orders if randomAggQtyMinimum and/or randomAggAmtMinimum have a value. |

randomAmtMaximum |

Decimal |

The amount used to derive the maximum quantity that can be created by the Random Order Generator (uses randomQtyMaximum by default or if randomQtyMaximum has a lower value than the quantity derived from this value) Used only for passive orders if randomAggQtyMaximum and/or randomAggAmtMaximum have a value. |

randomAggQtyMinimum |

Decimal |

The minimum quantity that can be created by the Random Order Generator for aggressive orders (uses randomQtyMinimum by default) |

randomAggQtyMaximum |

Decimal |

The maximum quantity that can be created by the Random Order Generator for aggressive orders (uses randomQtyMaximum by default) |

randomAggAmtMinimum |

Decimal |

The amount used to derive the minimum quantity that can be created by the Random Order Generator for aggressive orders (uses randomAggQtyMinimum by default or if randomAggQtyMinimum has a higher value than the quantity derived from this value) |

randomAggAmtMaximum |

Decimal |

The amount used to derive the maximum quantity that can be created by the Random Order Generator for aggressive orders (uses randomAggQtyMaximum by default or if randomAggQtyMaximum has a lower value than the quantity derived from this value) |

randomDepthLevels |

Integer |

Maximum count of depth levels that can be created by Random Order Generator (no limit by default) |

randomOrdersSpread |

Decimal |

The smallest top of book bid/ask price difference for prices created by the Random Order Generator (uses priceTickSize by default) |

randomOrdersRate |

Integer |

The number of order actions (new order/modification/cancel/wait) per second during Random Order Generation |

randomTickRange |

Integer |

Range of price ticks used to calculate prices created by the Random Order Generator (10 by default) |

randomOrdersEnabled |

Boolean |

Indicates if the Random Order Generator has to generate random orders on a listing |

enabled |

Boolean |

Indicates if the listing is enabled and should be used by the Market Simulator |

Get Single Listing

Request a single market simulator listing entity via id.

Resource URI

GET /api/listings/{id}

Request a single market simulator listing entity via symbol.

Resource URI

GET /api/listings/{symbol}

Example: Request by symbol

GET /api/listings/DE0007664005 HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhostExample: Positive reply

HTTP/1.1 200 OK

Connection: Close

Content-Length: XXX

{

"id" : 1,

"symbol" : "DE0007664005",

"venueId" : "XETRA",

"securityType" : "CS",

"priceCurrency" : "EUR",

"fxBaseCurrency" : "",

"instrSymbol" : "DE0007664005",

"securityExchange" : "XETR",

"partyId" : "",

"partyRole" : "",

"cusipId" : "",

"sedolId" : "",

"isinId" : "DE0007664005",

"ricId" : "",

"exchangeSymbolId" : "",

"bloombergSymbolId" : "",

"qtyMinimum" : 1.0,

"qtyMaximum" : 100000.0,

"qtyMultiple" : 1.0,

"priceTickSize" : 0.001,

"enabled" : true,

"randomQtyMinimum" : 1.0,

"randomQtyMaximum" : 700.0,

"randomAmtMinimum" : 0.0,

"randomAmtMaximum" : 0.0,

"randomDepthLevels" : 7,

"randomOrdersSpread" : 0.01,

"randomOrdersRate" : 7,

"randomTickRange" : 100,

"randomOrdersEnabled" : true,

"randomAggQtyMinimum" : 2.0,

"randomAggQtyMaximum" : 200.0,

"randomAggAmtMinimum" : 1000.0,

"randomAggAmtMaximum" : 3000.0

}Example: Negative reply

HTTP/1.1 404 Not Found

Connection: Close

Content-Length: XXX

{

"result" : "No such listing"

}| Market Simulator selects a listing by both symbol and VenueID implicitly when a GET request is received with a symbol. The VenueID value is taken from the simulator instance configuration. |

Get Multiple Listings

Request all market simulator listings entities.

Resource URI

GET /api/listings/

Example: Request multiple listings

GET /api/listings HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhostExample: Possible reply

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: XXX

{

"listings": [

{

"id": 1,

"symbol": "DE0007664005",

"venueId": "XETRA",

"securityType": "CS",

"priceCurrency": "EUR",

"fxBaseCurrency": "",

"instrSymbol": "DE0007664005",

"securityExchange": "XETR",

"partyId": "",

"partyRole": "",

"cusipId": "",

"sedolId": "",

"isinId": "DE0007664005",

"ricId": "",

"exchangeSymbolId": "",

"bloombergSymbolId": "",

"qtyMinimum": 1,

"qtyMaximum": 1000000,

"qtyMultiple": 1,

"priceTickSize": 0.001,

"randomQtyMinimum": 1,

"randomQtyMaximum": 1000,

"randomAmtMinimum": 0,

"randomAmtMaximum": 0,

"randomDepthLevels": 10,

"randomOrdersSpread": 1,

"randomOrdersRate": 1,

"randomTickRange": 10,

"randomAggQtyMinimum" : 2.0,

"randomAggQtyMaximum" : 200.0,

"randomAggAmtMinimum" : 1000.0,

"randomAggAmtMaximum" : 3000.0

},

{

"id": 3,

"symbol": "EUR/USD",

"venueId": "FASTMATCH",

"securityType": "FXSPOT",

"priceCurrency": "USD",

"fxBaseCurrency": "EUR",

"instrSymbol": "EUR/USD",

"securityExchange": "FASTMATCH",

"partyId": "",

"partyRole": "",

"cusipId": "",

"sedolId": "",

"isinId": "",

"ricId": "",

"exchangeSymbolId": "",

"bloombergSymbolId": "",

"qtyMinimum": 1,

"qtyMaximum": 1.0E8,

"qtyMultiple": 1,

"priceTickSize": 0.001,

"randomQtyMinimum": 1,

"randomQtyMaximum": 1.0E7,

"randomAmtMinimum": 0,

"randomAmtMaximum": 0,

"randomDepthLevels": 3,

"randomOrdersSpread": 1.0E-4,

"randomOrdersRate": 1,

"randomTickRange": 10,

"randomAggQtyMinimum" : 2.0,

"randomAggQtyMaximum" : 200.0,

"randomAggAmtMinimum" : 1000.0,

"randomAggAmtMaximum" : 3000.0

}

]

}Add Listing

Add a new market simulator listing entity.

Resource URI

POST /api/listings/

Example: Request to add a new listing

POST /api/listings HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhost

{

"symbol" : "AAPL",

"venueId" : "XETRA",

"instrSymbol" : "AAPL",

"securityType" : "CS",

"qtyMinimum" : 1,

"qtyMaximum" : 100000,

"randomQtyMultiple" : 1,

"randomQtyMinimum" : 200,

"randomQtyMaximum" : 1100,

"randomAmtMinimum" : 100,

"randomAmtMaximum" : 2000,

"randomOrdersEnabled" : false,

"enabled" : false

}Example: Positive reply

HTTP/1.1 201 Created

Connection: Close

Content-Length: XXX

{

"result" : "Requested insert of the listing - AAPL"

}Example: Negative reply

HTTP/1.1 400 Bad Request

Connection: Close

Content-Length: XXX

{

"result" : "There is already such listing"

}Update Listing

Update existing market simulator listing entity via ID.

Resource URI

PUT /api/listings/{listingId}

Example: Request to update a listing

PUT /api/listings/AAPL HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhost

{

"enabled" : true,

"randomOrdersEnabled" : true

}Example: Positive reply

HTTP/1.1 200 OK

Connection: Close

Content-Length: XXX

{

"result" : "Requested update of the listing - AAPL"

}Example: Negative reply

HTTP/1.1 404 Not Found

Connection: Close

Content-Length: XXX

{

"result" : "No such listing"

}Update existing market simulator listing entities via Symbol.

Resource URI

PUT /api/listings/{symbol}

Example: Request to update a new listing

PUT /api/listings/AAPL HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhost

{

"priceTickSize" : 0.001,

"qtyMultiple" : 2

}Example: Positive reply

HTTP/1.1 200 OK

Connection: Close

Content-Length: XXX

{

"result" : "Requested update of the listing - AAPL"

}Example: Negative reply

HTTP/1.1 404 Not Found

Connection: Close

Content-Length: XXX

{

"result" : "No such listing"

}| Market Simulator updates a listing by both symbol and VenueID implicitly when a PUT request is received with a symbol. The VenueID value is taken from the simulator instance configuration. |

Data Sources

Manage settings for specific data sources on each market simulator instance.

See this section for more information about playback of data from data sources.

Resource Properties

| Path | Type | Description |

|---|---|---|

id |

Numeric |

Unique primary key |

enabled |

Boolean |

Whether or not this data source is enabled or disabled |

name |

Text |

Name for this data source, unique to the venue |

venueId |

Text |

Unique venue key for a data source |

connection |

Text |

Connection string for the datasource (eg a file path for CSV files, or a database connection string for database connections). |

format |

Text |

Indicates the type of historic data storage. Supported values:

|

type |

Text |

Indicates the data source format. Supported values:

|

repeat |

Boolean |

Whether to start reading from the beginning of the data source when the end is reached (supported only for files and databases) |

textDelimeter |

Char |

Delimiter used to separate values ("," by default if not specified) (supported only for CSV format) |

textHeaderRow |

Integer |

1-based row index of where header row is located (0 indicates no header row) (supported only for CSV format) |

textDataRow |

Integer |

1-based row index of where the first row of data is located.

Cannot be 0, and must be greater than |

tableName |

Text |

Name of table (supported only for databases) |

maxDepthLevels |

Integer |

Maximum depth levels to read from the data source. 0 or unspecified indicates to read all levels. |

Column Mapping Sub-List

| Path | Type | Description |

|---|---|---|

dataSourceId |

Integer |

An identifier of the data source record which has a column mapping config. Users may omit to send this value in the requests. |

columnFrom |

Enum |

Internal simulator field for mapping data. Supported values (part 1, continued on next page):

|

columnFrom |

Enum |

Internal simulator field for mapping data. Supported values (part 2, continued from previous page): Any bid or ask level missing a price or quantity value is considered to be empty and removed from the state of the matching engine. If the party value for a bid or ask level is missing, a default value of “CP#” is used, where # is the index for each level (e.g. level 1 would use CP1, etc). If the datasource contains several levels, a 1-based level index must be appended to each of column names BidParty, BidQuantity, BidPrice, AskPrice, AskQuantity, AskParty. For example, BidParty1, BidParty2 etc. The # character can also be used with these fields to indicate reading from whatever index levels are specified in the file or database itself. For example, BidParty#, BidQuantity# etc. |

columnTo |

Text |

External data source column name for mapping data. If the datasource contains several levels, the # character can be used as a placeholder for the level number.

For instance, In the case of CSV format, a 1-based column number can be indicated to specify the position of columns instead of the name of columns.

To use this method, |

Get Single Data Source

Request a single market simulator data source entity.

Resource URI

GET /api/datasources/{id}

Example: Request single data source

GET /api/datasource/1 HTTP/1.1

Accept: application/json;charset=UTF-8

Host: localhostExample: Positive reply

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: XXX

{

"id" : 1,

"enabled" : false,

"name" : "LSE1",